minus

explicabo

ullam

It is a long established fact that a reader be distracted by the readable content.

It is a long established fact that a reader be distracted by the readable content.

It is a long established fact that a reader be distracted by the readable content.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled.

We always provide people a complete solution focused of

any

business.

We always provide people a complete solution focused of

any

business.

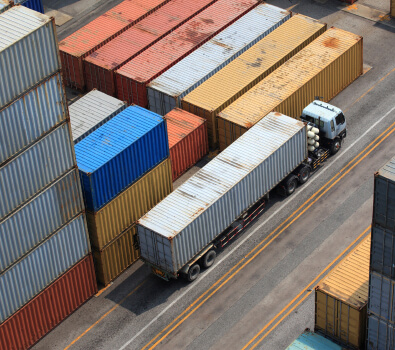

A logistic service provider company plays a pivotal role in the global supply chain logistic service.

A logistic service provider company plays a pivotal role in the global supply chain logistic service.

A logistic service provider company plays a pivotal role in the global supply chain logistic service.

A logistic service provider company plays a pivotal role in the global supply chain logistic service.

A logistic service provider company plays a pivotal role in the global supply chain logistic service.

A logistic service provider company plays a pivotal role in the global supply chain logistic service.

A logistic service provider company plays a pivotal role in the global supply chain logistic service.

A logistic service provider company plays a pivotal role in the global supply chain logistic service.

A logistic service provider company plays a pivotal role in the global supply chain logistic service.

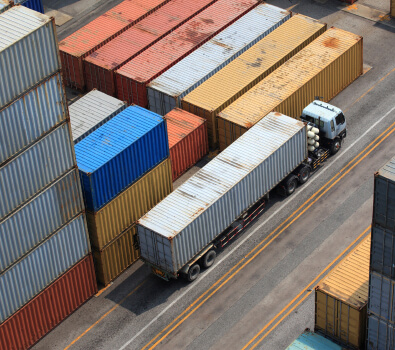

Logistic service provider company plays a pivotal role in the global supply chain

Logistic service provider company plays a pivotal role in the global supply chain

Logistic service provider company plays a pivotal role in the global supply chain

Logistic service provider company plays a pivotal role in the global supply chain

Logistic service provider company plays a pivotal role in the global supply chain

Logistic service provider company plays a pivotal role in the global supply chain

Logistic service provider company plays a pivotal role in the global supply chain

Logistic service provider company plays a pivotal role in the global supply chain

Logistic service provider company plays a pivotal role in the global supply chain

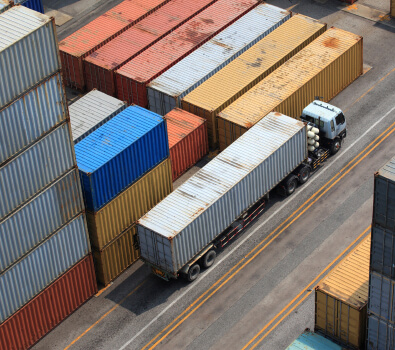

Pickup and delivery

Custom coverage

Customer Management

Deliver in 2-3 days

24 Hours Support

Pickup and delivery

Custom coverage

Customer Management

Deliver in 2-3 days

24 Hours Support

Pickup and delivery

Custom coverage

Customer Management

Deliver in 2-3 days

24 Hours Support

Distribution Center

Countries & Regions

Years Of Expirence

Phosfluorecent synergize holistic leadership skills before effective technology.

Phosfluorecent synergize holistic leadership skills before effective technology.

Phosfluorecent synergize holistic leadership skills before effective technology.