.

Post your Loads & Trucks

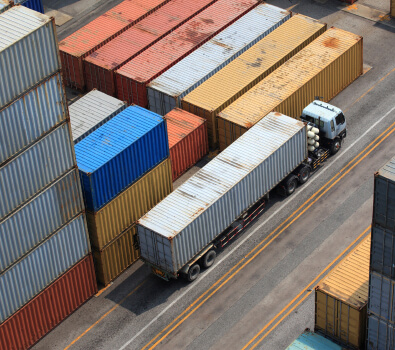

No Worry after Uberlogistic

Free register, unlimited Access

Free register, unlimited Access

.jpg)

One Load

One Truck

Public Document

No Insurance

Email Support

Pickup and delivery

Custom coverage

Customer Management

Deliver in 2-3 days

24 Hours Support

Pickup and delivery

Custom coverage

Customer Management

Deliver in 2-3 days

24 Hours Support

Pickup and delivery

Custom coverage

Customer Management

Deliver in 2-3 days

24 Hours Support

Distribution Center

Distribution Center

Years of experience